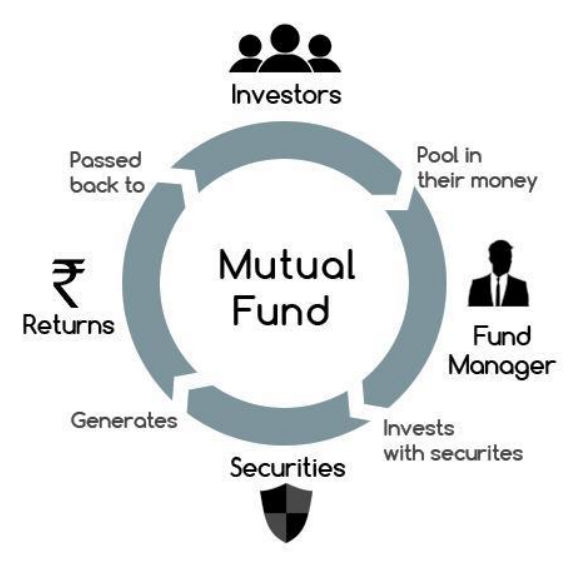

‘Mutual fund’ is an investing instrument that pools the funds of investors to invest in various financial securities such as bonds, stocks, money market instruments, and other class of assets. These mutual funds are managed by Fund Managers. These managers, with their expertise invest the money/investments in various securities to help the investor gain better risk adjusted returns.

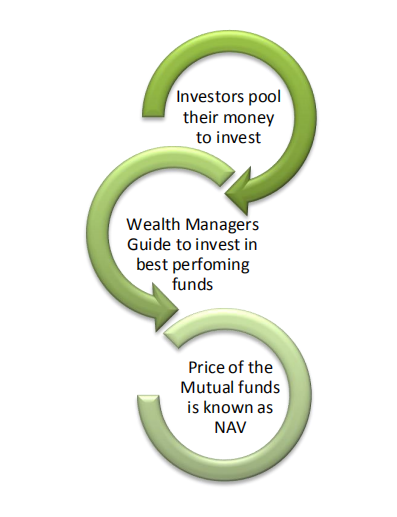

PRICE OF MUTUAL FUNDS

Mutual funds act as the gateway to various professionally managed portfolios for the investors. Whenever you are buying mutual funds you are particularly investing in the performance of a portfolio. The price of mutual funds is known as Net Asset Value (NAV)

The price/NAV of the mutual funds doesn’t fluctuate during market hours like stocks, but is settled on daily basis. Hence, once can invest in or redeem the investment in mutual funds at the current NAV

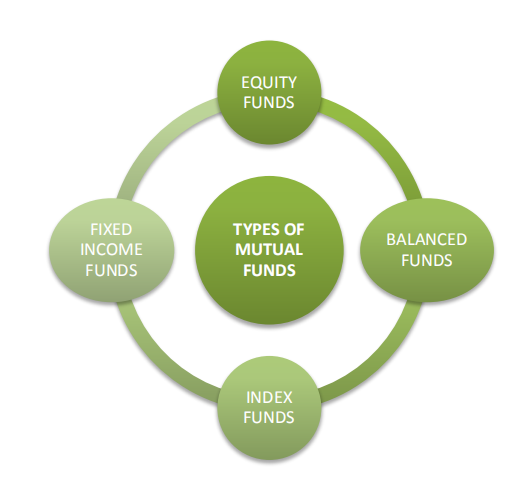

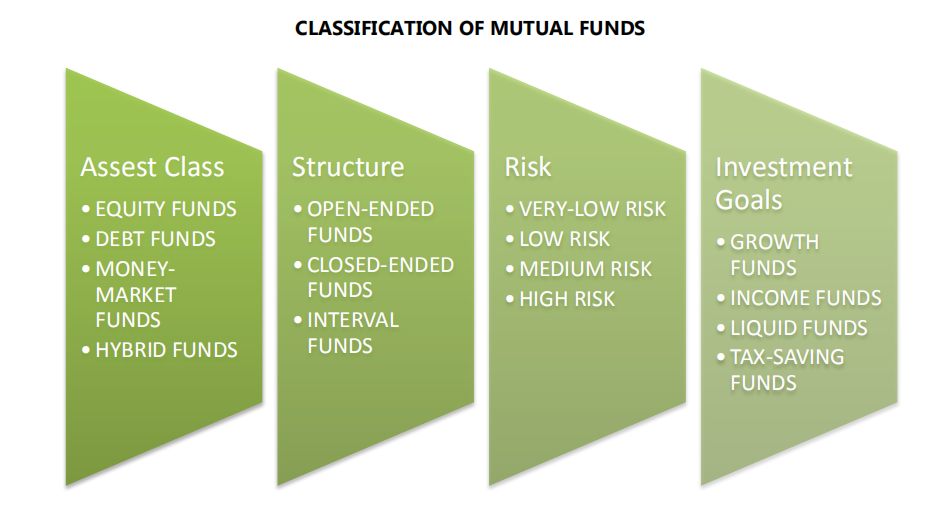

TYPES OF MUTUAL FUNDS

- Equity Funds

- Balanced Funds

- Fixed-income funds

- Index funds

BALANCED FUNDS - As the name suggests, the investment under this category goes in the bonds and equity instruments (both). This lowers the risk due to investing in more than one class of assets. However the returns depends on the performance of asset.

FIXED INCOME FUNDS - This type of mutual funds provides a fixed rate of return to the investors. These returns are available in corporate bonds, government bonds etc. The principle that works behind the fixed return is that these portfolios generate regular interest income which is then transferred to the investors.

INDEX FUNDS - These funds are designed for the cost-effective investors and have lately become a popular choice. Index funds don’t require any typical advisory. These are generated to match the constituents of the financial market index. These funds provide an all-encompassing market exposure, lower operating costs and low portfolio turnover.

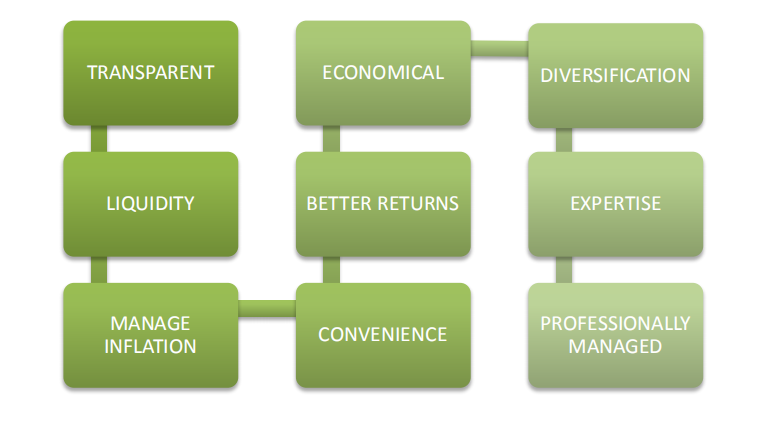

WHY CHOOSE MUTUAL FUNDS?

ADVANTAGES IN DETAIL

ADVANTAGES IN DETAIL

Diversification - Generally, all funds offer diversification by investing in a broad array of securities. Investment funds in general will help investors diversify away the idiosyncratic risks that can affect one security or a group of securities in a specific sector. When seeking diversified funds, investor may need to closely consider the types of risks they wish to mitigate.

Convenience - Mutual funds are known to eliminate the risk-factor that an investor faces while investing in a particular stock or bond. Mutual funds give you the share in different assets and hence are way too convenient from investing point of view.

Liquidity - It is easier to switch in Mutual funds in the need of hour. An investor can make a switch anytime and the degree of loss is comparatively less due to diversification. Liquidity is one of the most important features of mutual fund investment.

Professional management - Mutual funds are managed by professionals who have a proper backing of research and markets know-how. So whenever you invest in Mutual funds, you are automatically investing in a professionally managed fund with reliable returns. That is the reason Mutual funds are known as professionally managed funds.